Cryptocurrency has rapidly transformed from a niche interest to a global financial phenomenon. As Bitcoin, Ethereum, and other digital assets gain mainstream acceptance, governments worldwide are grappling with how to regulate this fast-evolving space. Understanding cryptocurrency regulations around the world is crucial for investors, businesses, and blockchain innovators. In this comprehensive guide, we explore how different countries approach cryptocurrency regulation in 2025.

Why Cryptocurrency Regulations Matter

Cryptocurrency regulation is essential for protecting investors, preventing illicit activities like money laundering, and fostering innovation. However, regulatory approaches vary widely depending on each country’s financial system, political stance, and economic priorities.

Effective regulation can help stabilize markets, enhance security, and encourage institutional investment. On the other hand, overly restrictive policies can stifle innovation and drive crypto projects to more favorable jurisdictions. Calculator

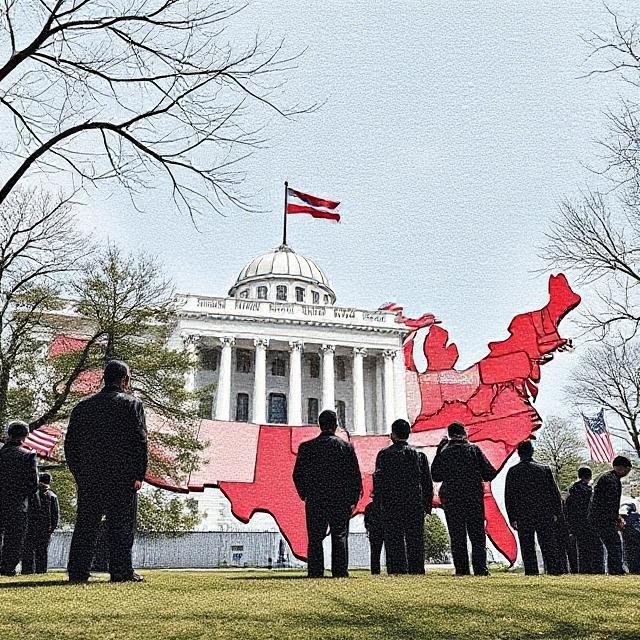

The United States: Stricter Oversight in 2025

The United States has taken significant steps toward clearer cryptocurrency regulation in recent years. The Securities and Exchange Commission (SEC) now classifies many crypto tokens as securities, subjecting them to stringent disclosure and compliance rules.

Additionally, the Commodity Futures Trading Commission (CFTC) oversees crypto derivatives, while the Financial Crimes Enforcement Network (FinCEN) enforces anti-money laundering (AML) measures. In 2025, the U.S. has introduced new tax reporting rules requiring brokers and exchanges to report crypto transactions over $600.

Despite stricter oversight, the U.S. remains a hub for blockchain innovation, with several states like Wyoming and Texas offering crypto-friendly policies.

European Union: A Unified Regulatory Framework

The European Union (EU) has adopted a more harmonized approach with the introduction of the Markets in Crypto-Assets (MiCA) regulation. Enacted in 2024, MiCA provides a comprehensive framework governing crypto issuance, trading, and custody services.

Key features of MiCA include:

- Licensing requirements for crypto service providers

- Consumer protection measures

- AML and combating the financing of terrorism (CFT) obligations

EU member states, including Germany and France, have embraced these regulations, providing legal clarity for businesses and investors. The unified framework positions the EU as a leading player in shaping global crypto policy.

China: The Strictest Ban

China maintains one of the strictest stances against cryptocurrency. In 2021, it banned crypto mining and declared all crypto transactions illegal. This position has not changed in 2025, with authorities continuing to crack down on underground crypto activities.

However, China is at the forefront of central bank digital currency (CBDC) development, with its Digital Yuan already in widespread use. The government promotes blockchain technology while maintaining tight control over financial activities.

Japan: A Balanced Approach

Japan was one of the first countries to regulate cryptocurrency, recognizing Bitcoin as legal property back in 2017. The Financial Services Agency (FSA) oversees crypto exchanges and enforces strict AML compliance.

In 2025, Japan has enhanced its regulations to improve consumer protection, requiring exchanges to segregate customer assets and maintain robust cybersecurity protocols. This balanced approach has fostered a thriving crypto ecosystem while ensuring investor safety.

El Salvador: Bitcoin as Legal Tender

El Salvador made headlines in 2021 by becoming the first country to adopt Bitcoin as legal tender. As of 2025, the government continues to promote Bitcoin usage through its Chivo wallet and other initiatives.

While this move has attracted international attention and investment, it has also raised concerns from global financial institutions like the International Monetary Fund (IMF). Nevertheless, El Salvador remains committed to its Bitcoin experiment.

United Arab Emirates: Crypto-Friendly Policies

The United Arab Emirates (UAE), particularly Dubai and Abu Dhabi, has positioned itself as a global crypto hub. The Dubai Virtual Assets Regulatory Authority (VARA) was established to oversee crypto activities.

The UAE offers clear licensing frameworks for exchanges, custody providers, and token issuers. This regulatory clarity has attracted major crypto firms and fostered innovation in blockchain-based finance.

India: Ambiguous Yet Evolving

India’s approach to cryptocurrency regulation has been marked by ambiguity. After considering an outright ban, the government has shifted towards regulation.

In 2025, India imposes a 30% tax on crypto profits and a 1% tax deducted at source (TDS) on transactions. While this high taxation has drawn criticism, it indicates the government’s recognition of crypto’s presence in the financial ecosystem.

Ongoing discussions suggest that India may introduce a comprehensive crypto bill to provide greater clarity in the near future.

Brazil and Latin America: Growing Adoption

Brazil and other Latin American countries like Argentina and Colombia are witnessing rapid crypto adoption. Brazil’s Securities and Exchange Commission (CVM) and Central Bank have issued guidelines recognizing crypto as an investment asset.

With inflation concerns driving interest in digital assets, countries in the region are exploring regulatory frameworks that balance innovation with risk management.

Africa: Diverse Regulatory Landscape

Africa’s crypto regulations vary widely. Countries like Nigeria have imposed banking bans on crypto transactions, while others like South Africa are developing regulatory frameworks.

In 2025, South Africa’s Financial Sector Conduct Authority (FSCA) requires crypto exchanges to register and comply with AML rules. Meanwhile, Kenya and Ghana are piloting CBDCs, signaling growing interest in digital finance.

Australia and New Zealand: Proactive Regulation

Australia has established itself as a crypto-friendly jurisdiction, with the Australian Securities and Investments Commission (ASIC) providing guidance on crypto assets. In 2025, new regulations mandate licensing for exchanges and custodians.

New Zealand follows a similar path, ensuring that crypto activities fall under existing financial laws, providing investor protection and market integrity.

The Future of Global Crypto Regulation

As we move further into 2025, it’s clear that cryptocurrency regulation is becoming more sophisticated and widespread. Key trends shaping the future include:

- Greater emphasis on AML and CFT compliance

- Unified frameworks like the EU’s MiCA setting global standards

- Continued development of central bank digital currencies (CBDCs)

- Balancing innovation with consumer protection

Countries that offer clear, balanced regulations are likely to attract investment and become leaders in the blockchain revolution.

Conclusion

Cryptocurrency regulations around the world are as diverse as the nations themselves. From the strict bans in China to the crypto-friendly environments in the UAE and El Salvador’s bold Bitcoin experiment, the global regulatory landscape is dynamic and evolving.

For crypto investors, businesses, and enthusiasts, staying informed about these regulations is crucial. As 2025 unfolds, proactive adaptation to these changes will determine success in the world of digital assets.