Introduction

Imagine purchasing a cryptocurrency today, seeing its value skyrocket overnight, and feeling triumphant, only to witness it crash rapidly, erasing all your profits. This represents the volatile cycle of Crypto Bubbles, characterized by intense enthusiasm, sharp price increases, and sudden crashes that shock numerous investors.

Financial bubbles are not a modern phenomenon. Historical incidents such as the Tulip Mania in the 1600s, where tulip bulbs reached values comparable to houses, and the Dot-com Bubble, which saw tech stocks climb to unsustainable levels before plummeting, mirror the patterns seen in the crypto market. The cryptocurrency landscape has experienced similar fluctuations, evidenced by Bitcoin’s dramatic rise in 2017, the ICO frenzy, and the recent surge in NFTs and DeFi in 2021, all propelled by speculative trading, the fear of missing out, and extensive media coverage.

But why do these bubbles form? More critically, how can you recognize if you’re in the midst of one? This article will outline the clear indicators of a Crypto Bubble, explore the effects of these cycles, and reveal how astute investors manage them. Whether you’re a trader, a long-term investor, or simply intrigued by cryptocurrency, grasping these market dynamics can assist you in steering clear of the frenzy and making informed investment decisions.

What is a Crypto Bubble?

A financial bubble occurs when the price of an asset greatly exceeds its real value because of too much speculation and excitement. This price increase is motivated by investor enthusiasm rather than the asset’s actual use or genuine growth. Eventually, the bubble burst, leading to a sharp decline in prices and significant losses for many investors.

In the cryptocurrency world, bubbles occur when digital assets see quick increases in price driven by speculative actions. Unlike traditional investments that are influenced by company performance or economic indicators, cryptocurrency markets often depend on hype, social media influence, and emotional trading. As people hurry to invest, prices skyrocket until the initial excitement wanes, resulting in rapid and severe price drops.

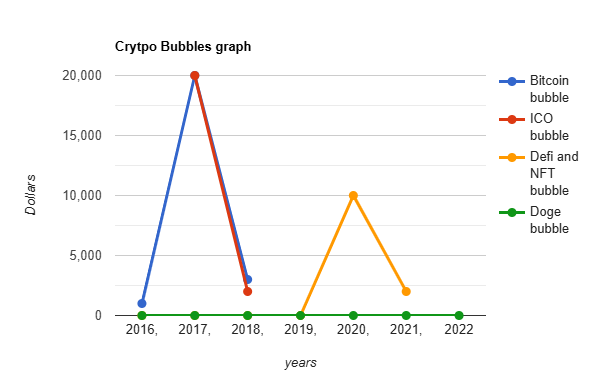

Several cryptocurrency bubbles have occurred historically:

- Bitcoin’s 2017 Surge: Bitcoin’s value soared from below $1,000 to almost $20,000 within a year, before plummeting more than 80% in 2018.

- ICO Boom (2017-2018): Many startups conducted initial coin offerings and raised billions. However, a lack of real utility in many projects led to a major collapse.

- NFT & DeFi Mania (2021): Digital art and decentralized finance tokens experienced incredibly high valuations before crashing in 2022.

- Meme Coin Frenzy (Dogecoin, Shiba Inu, etc.): These coins, which have minimal utility, experienced surges due to viral marketing and influencer endorsements, followed by significant declines.

Crypto bubbles offer both opportunities and risks. Some investors manage to profit by timing the market accurately, but many others suffer losses during the crash. Recognizing the signs of a bubble is vital for making informed investment decisions.

Major Crypto Bubbles in History

1. Bitcoin 2017 Bubble: From $1,000 to $20,000—Then the Crash

In 2017, Bitcoin experienced a historic price surge, jumping from under $1,000 to nearly $20,000 in just one year. This rapid rise was fueled by growing mainstream interest, media coverage, and investor FOMO (fear of missing out). Many people believed Bitcoin would replace traditional currencies, leading to a flood of new investors.

However, the excitement was short-lived. By early 2018, Bitcoin’s price collapsed by over 80%, dropping to around $3,000. Many investors who bought at the peak suffered huge losses. This was Bitcoin’s first major bubble, but unlike traditional bubbles, Bitcoin eventually recovered and hit new highs in later years.

2. ICO Bubble (2017-2018): The Rise and Fall of Initial Coin Offerings

During 2017-2018, a new fundraising method called Initial Coin Offering (ICO) took the crypto world by storm. Thousands of startups launched their cryptocurrencies, raising billions of dollars. Many investors jumped in, hoping to find the next big crypto project like Ethereum or Bitcoin.

However, most ICOs were based on speculation rather than real utility. Many projects had no working product, and some turned out to be scams. When the crypto market crashed in 2018, the value of most ICO tokens dropped by over 90%, leaving investors with huge losses. Governments and regulators cracked down on ICOs, bringing an end to the craze.

3. DeFi and NFT Bubble (2020-2022): Extreme Hype and Market Collapse

The 2020-2022 bull market saw two major trends take off: decentralized finance (DeFi) and non-fungible tokens (NFTs).

- DeFi platforms promised to revolutionize banking by allowing users to earn interest, trade, and lend crypto without traditional banks. However, many projects were poorly designed, offering unsustainable yields. The crash of Terra-LUNA in 2022, which wiped out billions, exposed the risks of DeFi.

- NFTs became a digital gold rush, with people buying unique digital images, like Bored Apes and CryptoPunks, for millions of dollars. But as the hype faded, NFT values plummeted by 90% or more, leaving many investors with worthless assets.

4. Meme Coin Bubble: The Rise and Fall of Dogecoin and Shiba Inu

Meme coins like Dogecoin and Shiba Inu gained massive popularity, thanks to viral marketing and celebrity endorsements—most notably Elon Musk’s tweets about Dogecoin. Investors rushed in, driving Dogecoin’s price from a fraction of a cent to $0.73 in May 2021.

However, meme coins lacked real-world utility, and once the hype died down, their prices crashed by over 85%. Many investors who bought at the peak faced huge losses, proving how risky hype-driven investments can be.

Each of these crypto bubbles followed the same pattern—rapid rise, extreme hype, and inevitable crash. While some investors made fortunes, many lost everything. Understanding these cycles can help investors avoid getting caught in the next bubble.

Why Do Crypto Bubbles Form?

Crypto bubbles don’t just happen randomly—they are driven by a combination of speculation, market dynamics, and innovation. Here are the key reasons why these bubbles form and why investors often get caught in them.

1. Speculation and Hype: The Power of Social Media and FOMO

One of the biggest drivers of crypto bubbles is speculation fueled by hype. Social media platforms like Twitter, Reddit, and YouTube, along with influential figures, play a massive role in driving crypto prices up.

- Influencers and celebrities often promote certain coins, creating a frenzy among retail investors.

- News of skyrocketing prices spreads quickly, triggering FOMO (Fear of Missing Out). People rush to buy, hoping to make quick profits, further pushing prices higher.

- However, when the hype dies down, reality sets in—leading to a market crash.

This cycle of hype, buying, and eventual panic-selling is what makes crypto bubbles so volatile.

2. Lack of Regulation: A Playground for Speculation

Traditional financial markets are regulated to prevent fraud and protect investors. But in the crypto world, regulation is still evolving, creating a breeding ground for speculation and manipulation.

- Many projects make big promises with little accountability—some even turn out to be scams.

- Since crypto markets are open 24/7 and global, there are fewer restrictions on who can invest, leading to wild price swings driven by unverified news or rumors.

- Without strong oversight, bad actors can artificially inflate prices, only to dump their holdings later, leaving retail investors with losses.

The lack of clear rules makes crypto investing highly risky, especially during speculative bubbles.

3. Liquidity and Market Manipulation: The Role of Whales and Pump-and-Dump Schemes

Crypto markets are highly liquid, meaning traders can buy and sell quickly. However, this also makes them vulnerable to manipulation.

- Crypto whales (large holders) can move markets by making massive trades, creating artificial demand.

- Pump-and-dump schemes—where a group hypes up a coin, drives up the price, and then sells for profit—are common in the crypto space.

- Unlike stocks, many cryptocurrencies have low trading volumes, making it easier for a few players to control price movements.

These tactics make crypto markets highly unpredictable and increase the chances of a bubble forming.

4. Technological and Financial Innovation: Fueling Overvaluation

Blockchain technology is revolutionary, and innovations like smart contracts, DeFi, and NFTs promise to change industries. However, investors often overestimate the short-term impact of these technologies.

- New projects attract billions in investment before proving their real-world use case.

- Excitement over innovation leads to extreme valuations, even when the technology is still in its infancy.

- Eventually, when projects fail to deliver, prices collapse—bursting the bubble.

Crypto’s potential is undeniable, but history shows that many projects are overhyped, leading to unsustainable market booms and busts.

Understanding these factors can help investors navigate the crypto market wisely and avoid getting caught in the next bubble.

How to Identify a Crypto Bubble

Spotting a crypto bubble before it bursts can save investors from massive losses. Here are five key warning signs that indicate a market may be overheating.

1. Exponential Price Growth in a Short Time

If a cryptocurrency’s price skyrockets hundreds or thousands of percent in just weeks or months, it’s often a red flag. While crypto is known for volatility, sustainable growth takes time. A rapid surge usually means prices are driven by speculation rather than real demand.

For example, in 2017, Bitcoin surged from $1,000 to nearly $20,000, and in 2021, Dogecoin spiked 12,000% in a few months—both followed by crashes. If a coin’s price is rising too fast, it’s likely a bubble waiting to burst.

2. Unrealistic Promises and Hype

Many crypto projects promise revolutionary technology, guaranteed returns, or a future takeover of global finance. If a project claims to be the “next Bitcoin” or promises risk-free profits, it’s a major red flag.

Scammers and overhyped projects often use buzzwords like “decentralized revolution,” “moonshot,” or “100x gains” to attract investors. Always look for real-world use cases, working products, and a solid development team before investing.

3. High Leverage and Speculation

Crypto bubbles are often fueled by high leverage, where traders borrow money to buy assets. When markets are overleveraged, even small price drops trigger massive liquidations, leading to sudden crashes.

In the 2021 bull run, many traders used 100x leverage, meaning a 1% price drop could wipe out their entire position. If too many investors are using borrowed money, the bubble is fragile and can collapse quickly.

4. Celebrities and Influencers Promoting Coins

If a cryptocurrency is being heavily promoted by celebrities or influencers, be cautious. Many tokens surge simply because of endorsements, not because of their actual value.

For example, Elon Musk’s tweets pushed Dogecoin to all-time highs, but when the hype faded, the price crashed. If a coin relies on social media hype rather than solid fundamentals, it’s likely in a bubble.

5. Lack of Real Utility

The most dangerous bubbles form around coins with no real-world use case. If a crypto project exists only for speculation, its price is built on hype, not value.

Before investing, ask: What problem does this crypto solve? Who is using it? Does it have long-term potential? If the answers are unclear, the project may be a ticking time bomb.

By recognizing these signs, investors can avoid crypto bubbles and make smarter decisions.

The Aftermath: What Happens When a Bubble Pops?

When a crypto bubble bursts, the impact is swift and severe. Prices plummet, investors panic, and the entire market faces a painful reset. Here’s what happens next.

1. Market Crashes and Investor Losses

After a period of rapid growth, a crypto bubble eventually collapses. Prices fall sharply, often wiping out billions in market value within days or weeks. Investors who bought at the peak experience huge losses, while early sellers escape with profits.

For example, when Bitcoin’s 2017 bubble burst, it dropped from $20,000 to $3,000 in a year. The ICO crash of 2018 left many projects worthless, causing massive financial pain for those who invested blindly.

2. Regulatory Crackdowns

After a major crash, governments and financial regulators step in to protect investors and prevent future bubbles.

- The SEC cracked down on ICO scams after the 2017-2018 crash.

- China banned crypto transactions in response to rampant speculation.

- Regulators now closely monitor stablecoins, DeFi, and exchanges to prevent fraud.

While regulation can slow innovation, it also brings more security and legitimacy to the industry.

3. Lessons Learned and Long-Term Impact

Despite the chaos, crypto bubbles help the market mature. Weak projects fade away, while strong ones survive and evolve.

- Bitcoin and Ethereum recovered and grew stronger after past crashes.

- The industry became more focused on real utility instead of hype.

- Investors learned to be cautious of speculation and FOMO.

Each bubble reshapes crypto, pushing it toward long-term stability and adoption.

Conclusion

Crypto bubbles have been a recurring theme in the industry, driven by hype, speculation, and rapid price surges, followed by inevitable crashes. From Bitcoin’s 2017 rally to the ICO boom and NFT craze, history shows that unsustainable growth always leads to painful corrections.

The key lesson? Investors must stay informed and cautious. Instead of chasing hype, conducting thorough research, evaluating real utility, and understanding market risks are crucial for long-term success. The crypto space is filled with opportunities, but it also comes with extreme volatility. Managing risks through diversification, avoiding leverage, and not investing more than you can afford to lose is essential.

Looking ahead, crypto is here to stay, but the market will continue evolving. With increasing regulations, improved technology, and real-world adoption, the industry is maturing. Future bubbles will still occur, but investors who learn from past mistakes will be better prepared.

Instead of falling for get-rich-quick schemes, focus on projects with strong fundamentals, real innovation, and long-term potential. By staying rational and avoiding emotional investing, you can navigate the crypto market wisely and make informed decisions that stand the test of time.